When it comes to launching any business, I strongly suggest understanding fully why CAC & LTV is critical to your business.

I advise thinking about your end goals at the beginning and planning your route backwards from there, and you need to know your key metrics or KPIs in order to do that accurately.

I speak to a lot of entrepreneurs every week at various stages of their development, and I always ask them about how they plan to acquire clients…

The answers usually vary from the fantastic to the potentially ludicrous, but there’s no doubt that this is a tricky question. Remember the Highway of Clients (strategic partners) and your ideas of alternative strategies that can work without spending much money – pay close attention to those and think about those potential partners / routes to market from the very start of your business.

The second thing to keep in mind (and the equation I’m alluding to in the title) is understanding the cost of acquiring a user vs the amount of money each user will give you.

Sounds simple right? Well, kind of. It’s crucial to understand and plan your business around this idea, so make sure you’re working with clean data when approaching this equation. This will let you know if there’s a viable business model to test.

So, let’s elaborate:

Why CAC & LTV is critical to your business?

CAC = Customer Acquisition Cost = cost to bring onboard a user (ignore free/organic users for this, only look at paid channels)

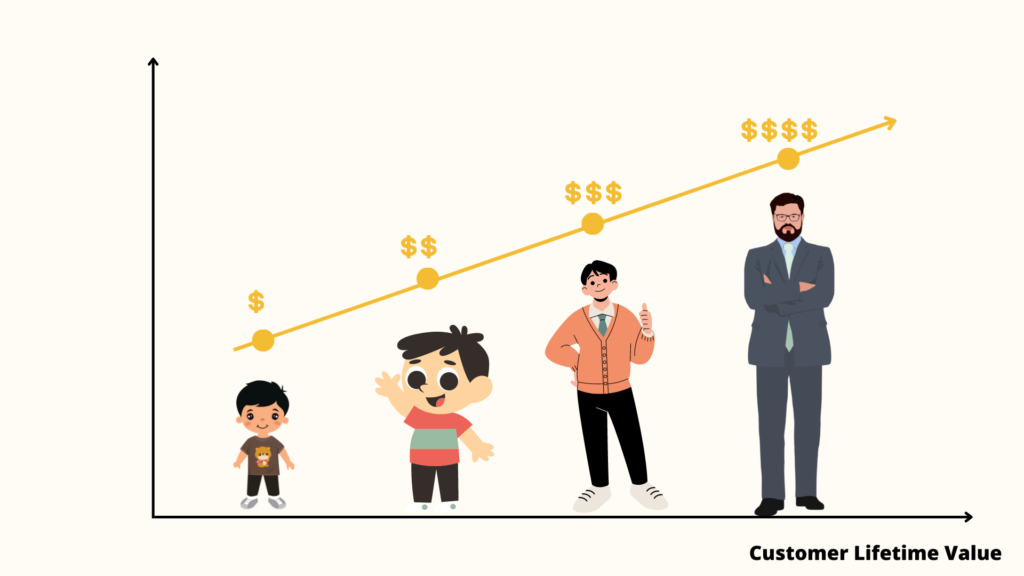

LTV = Lifetime Value = how much money you make from each user over the entirety of their relationship with you.

At a high level, if a user makes you more money than it costs you to acquire them, then you should repeat your process as long as you can while optimizing your margins.

CAC < LTV

That’s the key equation right there!

Here are what variables to consider when performing your calculations:

CAC (Customer Acquisition Cost):

What channels are you using? What’s the cost of Adwords vs Facebook vs Twitter? Most of the time, you do not simply have an advert leading to a download/ client, so make sure you have your analytics optimised so you can see EXACTLY how much it costs to get a user on each platform.

LTV (Customer Lifetime Value):

Not all users will pay you money. Depending on your business model, this will be more or less important – whether you are a freemium or advertising support, etc. Therefore, what is the average revenue you make per user? If you charge $100 for your services and only 10% of users pay for your service, then your LTV is $10, not $100. You can change the metric to look at your LTV per paying client, but you need to be 100% clear on what you’re tracking / measuring.

Either way, the key is to understand your KPIs (Key performance indicators) and their relationship to your customer acquisition costs by heart. This will affect all of your business decisions!

Track what you need to, and then focus on CRO (Conversion rate optimization) and not just on product development. The difference you can make to your business by reducing your CAC by 5% and increasing your LTV by 5% is potentially the difference between you working your socks off and you hiring someone to help you scale!

If you feel like you need more guidance with understanding why CAC & LTV is critical to your business, feel free to get in touch with me here or on Linkedin. It would be my pleasure to help you fully understand these two concepts and help you launch your business properly, without too much worry!